The Essential Guide to Opening a Small Business Bank Account

When embarking on the entrepreneurial journey, one of the first and most critical steps you should take is opening a small business bank account. This account will not only help separate your finances from your business dealings but also provide essential tools for managing your business’s finances effectively. This guide will explore why every small business owner should prioritize this move and how to navigate the process smoothly.

Table of Contents

The Importance of a Small Business Bank Account

Why Open a Small Business Bank Account?

Opening a small business bank account offers numerous benefits that can impact your business’s operational efficiency and legal clarity. Here are the primary reasons why this step is crucial:

- Legal and Tax Compliance: Keeps your personal and business finances distinct, simplifying tax preparation and enhancing legal clarity.

- Professionalism: Payments and expenses through a business account enhance credibility with suppliers and customers.

- Credit History: Establishes a credit history for your business, potentially easing future borrowing.

- Simplified Bookkeeping and Record-Keeping: Separating personal and business transactions eliminates the hassle of sorting through a mixed bag of expenses. This makes bookkeeping and record-keeping significantly easier, saving you valuable time and minimizing errors. Imagine generating accurate financial reports with a few clicks instead of spending hours untangling personal and business transactions!

- Enhanced Financial Tracking: A dedicated business bank account offers a clear view of your business’s financial health. With detailed transaction records and account statements, you can track income, expenses, and cash flow and identify areas for improvement. This empowers you to make data-driven decisions that optimize your financial performance and fuel growth.

- Improved Cash Flow Management: Free business bank accounts often include features like online bill pay and automated transfers. These features streamline cash flow management, allowing you to schedule payments efficiently and avoid late fees. Additionally, some accounts offer real-time transaction monitoring, enabling you to stay on top of your finances and identify potential cash flow issues before they snowball.

- Reduced Risk of Fraud: Mixing personal and business transactions increases the risk of unauthorized activity going unnoticed. A separate business bank account strengthens financial security. Dedicated accounts often have advanced fraud protection measures, including real-time transaction alerts and multi-factor authentication. This gives you peace of mind, knowing your business funds are safeguarded.

- Potential for Additional Business Services: Some banks offering free business bank accounts may provide access to additional business services at a discounted rate. These services can include merchant services for credit card processing, payroll solutions, or even loan programs specifically designed for small businesses.

- Building Business Credit History: As mentioned earlier, establishing a business credit history is crucial for securing loans or financing in the future. A business bank account is a stepping stone towards building a solid credit profile for your company. Consistent and responsible business account management demonstrates financial stability and creditworthiness to potential lenders.

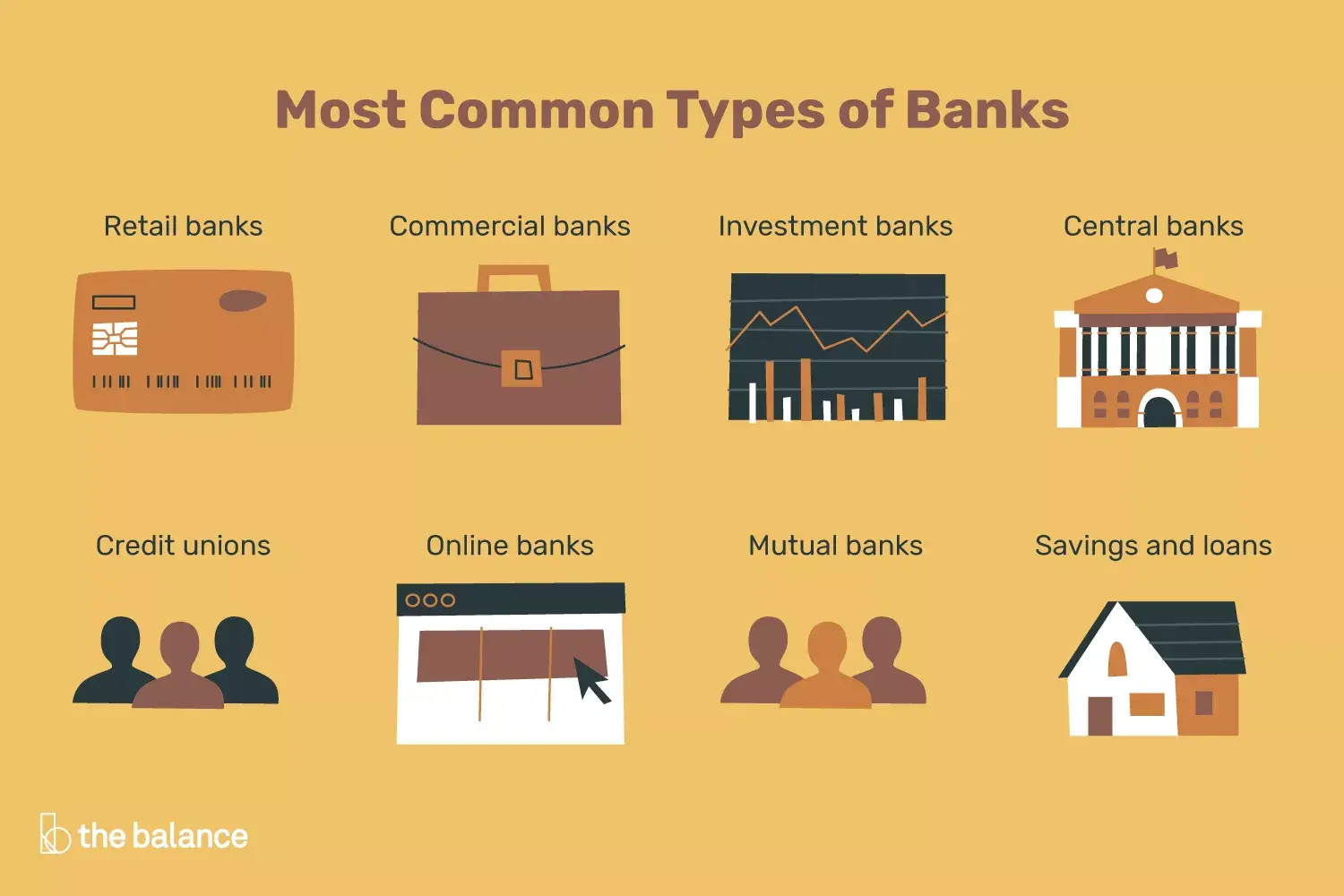

Choosing the Right Bank for Your Small Business

Evaluating Financial Institutions:

Choosing where to open your small business bank account involves careful consideration of several factors:

- Reputation and Reliability: Opt for institutions known for their solid reputation and reliability in handling business accounts.

- Fee Structure: Understand the fee structure, including monthly fees, transaction fees, and any hidden charges.

- Service Accessibility: Consider banks that offer comprehensive online banking, mobile access, and customer support through multiple channels.

- Additional Services: Look for banks that offer additional services such as merchant services, payroll management, and business credit products.

Setting Up Your Small Business Bank Account

Steps to Open Your Account:

Follow these steps to ensure a smooth process in setting up your new business bank account:

1. Choose the Right Account Type:

The first step is selecting an account that aligns with your business needs. Here’s a breakdown of the standard options:

- Accessible Business Checking: Ideal for everyday transactions like paying bills, receiving client payments, and managing payroll. Look for features like unlimited check writing, mobile check deposit, and debit card access.

- Business Savings Account: This is a good option for saving for future business expenses, emergencies, or long-term goals. Choose an account that offers competitive interest rates on your savings balance.

- Money Market Account: This is a hybrid of checking and savings accounts. It allows a limited number of transactions per month while earning interest on your funds. This can be suitable for businesses with fluctuating cash flow.

2. Gather Required Documentation:

Before applying, ensure you have all the necessary documents to expedite the process. Here’s a typical checklist:

- Employer Identification Number (EIN): Also known as a Federal Tax Identification Number, this unique identifier is essential for filing business taxes. You can obtain an EIN for free from the IRS website.

- Valid Government-Issued ID: This could be your driver’s license or passport for verification purposes.

- Business License or Permit: You might require a business license or permit to operate legally, depending on your industry and location.

- Organizational Documents: For corporations, these could be articles of incorporation. For partnerships, a partnership agreement would be required. Sole proprietors may need a business registration certificate.

- Proof of Address: A recent utility bill or lease agreement can prove your business address.

3. Research and Compare Banks:

Not all free business bank accounts are created equal. Take some time to research different banks and compare their offerings. Here are some key factors to consider:

- Monthly Fees: Some accounts have monthly maintenance fees, while others waive them if you meet specific requirements like maintaining a minimum balance.

- Transaction Limits: Be aware of any limitations on the monthly transactions allowed. Choose an account with limits that accommodate your business activity.

- Minimum Balance Requirements: As mentioned earlier, some accounts have minimum balance requirements to avoid monthly fees. Consider your business’s cash flow and choose an account with a suitable minimum balance threshold.

- Online Banking and Mobile App Features: Look for a user-friendly online banking platform and a mobile app that allows you to manage your finances remotely. Features like real-time transaction alerts and automated bill pay can be beneficial.

- Customer Service: Consider the bank’s reputation for customer service. Opt for a bank that offers reliable and responsive customer support to address any questions or concerns you may have.

- Additional Services: Some banks may offer additional services, such as merchant services for credit card processing or discounted business loans to account holders. Explore these options and choose a bank that aligns with your long-term business goals.

4. Apply Online or In-Person:

Many banks offer the convenience of online application for a free business bank account. The application process is straightforward and requires filling out a form with your business information and uploading the required documents. Alternatively, you can visit a branch and speak to a representative who can guide you through the application process.

5. Wait for Bank Approval and Receive Account Details:

Once you submit your application, the bank will review your information and documents. The approval process can take a few business days. Upon approval, you’ll receive your account details, including account numbers, routing numbers, and online banking login credentials.

6. Fund Your Account and Start Using It!

Once you have your account details, you can initiate the initial deposit to activate your account. Most banks allow you to fund your account electronically, with a check, or via cash deposit (depending on the bank’s policy). With your account up and running, you can start managing your business finances efficiently and keep your personal and business transactions separate.

Managing Your New Account

Best Practices for Small Business Banking:

Once your account is active, consider these tips to maximize its benefit to your business:

- Utilize Online Tools: Leverage online banking to manage your finances efficiently.

- Monitor Fees and Adjust: Monitor account fees and adjust your banking behaviors to minimize charges.

- Plan for Growth: As your business grows, reassess your needs and consider additional accounts or services.

FAQs on Opening a Small Business Bank Account

Q1: Can I open a business bank account online? Many banks offer the option to start your application online, though some may require in-person finalization.

Q2: What are the typical fees associated with a small business bank account? Fees can include monthly maintenance, transaction fees, and charges for additional services. These vary widely between banks.

Q3: How long does opening a small business bank account take? If you have all the required documents, it can take as little as one business day, though some banks might take longer to verify them.

Q4: What documents are required to open a small business bank account? Generally, you’ll need your business license, EIN (Employer Identification Number), personal identification, and documentation of your business structure, such as articles of incorporation or a partnership agreement.

Q5: Can a non-U.S. resident open a small business bank account in the U.S.? Yes, non-U.S. residents can open a business bank account in the U.S. Still, the process can be more complex and usually requires an in-person visit to the bank and additional documentation.

Q6: Are there any minimum balance requirements for a small business bank account? Many banks have minimum balance requirements to avoid fees or to qualify for additional perks. The specific amount varies by bank and account type.

Q7: What types of banking services are typically available for small businesses? Small business banking services can include checking and savings accounts, credit products such as loans and lines of credit, merchant services, payroll management, and sometimes investment advisory services.

Q8: How can I choose the best bank for my small business needs? Compare banks based on their fee structures, the convenience of their locations and online services, the responsiveness of their customer service, and the range of products they offer that match your business needs.

These FAQs should clarify the key considerations and steps in opening and managing a small business bank account.

Conclusion:

Opening a small business bank account is foundational in setting your business up for financial success. By choosing the right bank, managing your account wisely, and using the services offered, you can improve your business’s economic health and focus more on growth and development. Remember, the right bank will partner in your business journey, providing support and services that help you achieve your business goals. Decide to open your small business bank account today and take a significant step towards securing your business’s financial future.