Mastering the Art of Managing Business Finances: A Comprehensive Guide to Financial Success

In the ever-evolving business world, mastering the art of managing business finances is a necessity for aspiring and established entrepreneurs alike. The pathway to financial success is fraught with complexities, yet it is within these intricacies that the opportunity for growth and sustainability lies. This comprehensive guide aims to illuminate the path, offering insights and strategies to navigate the financial facets of your business with confidence and understanding.

Table of Contents

The Importance of Managing Business Finances

The cornerstone of any successful business lies in its ability to manage finances effectively. This is not merely about keeping the lights on but fostering an environment where growth, expansion, and innovation can thrive. Effective financial management serves as the bedrock for strategic decision-making, providing the clarity needed to navigate market uncertainties, capitalize on opportunities, and mitigate risks. It is the difference between merely surviving in the competitive business landscape and flourishing.

For small businesses, in particular, managing finances adeptly is crucial. The margin for error is often slim, and financial missteps have the potential to derail even the most visionary enterprises. Through meticulous financial management, small businesses can optimize their resources, ensuring every dollar works towards the realization of their goals.

Moreover, understanding and managing business finances is not just about securing the present but also about paving the way for a prosperous future. It involves a delicate balance between addressing immediate needs and planning for long-term objectives, a balance that is essential for sustaining business viability and fostering growth.

Understanding the Basics of Business Finance Management

At its core, business finance management revolves around optimizing a company’s financial resources. This entails a thorough understanding of both the inflow and outflow of funds, ensuring that the business remains solvent and profitable. The first step in mastering this discipline is grasping the fundamental principles that underpin financial operations within a business setting.

One such principle is cash flow, which refers to the movement of money into and out of the business. Healthy cash flow indicates a business’s ability to meet its obligations, invest in growth opportunities, and build a financial cushion to weather economic downturns. Conversely, poor cash flow can lead to financial strain, limiting a business’s operational capabilities and growth prospects.

Another critical aspect of business finance management is budgeting. This involves forecasting revenue and expenses to create a financial blueprint for the business. A well-crafted budget serves as a roadmap, guiding financial decisions and ensuring that resources are allocated efficiently towards achieving business objectives.

Vital Financial Statements Every Business Owner Should Know

Navigating the financial landscape requires familiarity with several critical financial statements. These documents offer insights into a business’s economic health and are essential tools for informed decision-making. The balance sheet, income statement, and cash flow statement form the triad of financial reports that every business owner should be conversant with.

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It details the business’s assets, liabilities, and equity, offering a comprehensive overview of its economic standing. Understanding the balance sheet is crucial for assessing the company’s liquidity, solvency, and overall financial health.

The income statement, also known as the profit and loss statement, outlines the company’s revenues, expenses, and profitability over a specified period. It highlights the business’s operational efficiency and ability to generate profit from its core activities. Regularly reviewing the income statement can help business owners identify trends, assess performance, and make strategic adjustments to enhance profitability.

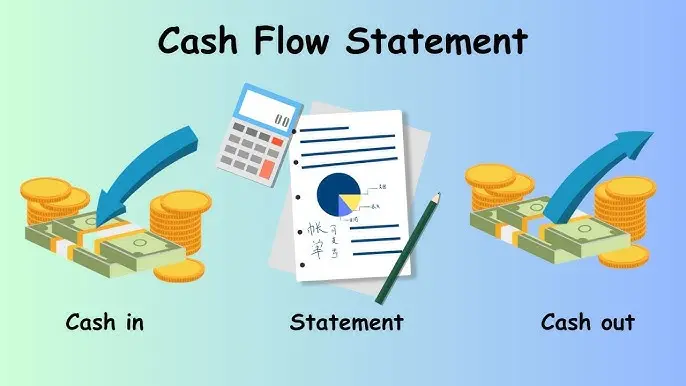

The cash flow statement tracks the flow of cash in and out of the business, providing insights into its liquidity and cash management practices. It is an invaluable tool for understanding how well the company manages its cash resources, highlighting areas where improvements can be made to bolster financial stability.

Budgeting and Forecasting for Small Businesses

Budgeting and forecasting stand as pivotal elements in the financial management toolkit, especially for small businesses. These processes enable business owners to plan for the future with a degree of certainty, setting financial targets and outlining strategies to achieve them. A well-conceived budget acts as an economic framework within which the business operates, ensuring that resources are allocated effectively to support operations and drive growth.

Forecasting takes this a step further by projecting future financial performance based on historical data and market analysis. It allows business owners to anticipate changes in the business environment, adjust strategies accordingly, and position their enterprises for success. Regular forecasting can aid in identifying potential financial challenges and opportunities, enabling proactive rather than reactive management.

Effective budgeting and forecasting require a deep understanding of the business’s financial patterns, market trends, and external factors that could impact performance. They demand a commitment to regular review and adjustment, ensuring that the economic strategy remains aligned with the business’s evolving goals and circumstances.

Effective Cash Flow Management Strategies

Cash flow management is the lifeblood of any business, dictating its ability to operate smoothly and meet its financial obligations. Effective cash flow management strategies are essential for maintaining liquidity, ensuring that the company has sufficient cash on hand to cover day-to-day operations and invest in growth initiatives.

One key strategy is to monitor accounts receivable and payable closely. This involves implementing policies that encourage prompt payment from customers, such as offering early payment discounts or enforcing late payment penalties. Concurrently, managing payables to take advantage of credit terms without incurring late fees can help maintain a healthy cash balance.

Another strategy is to maintain a cash reserve, a financial buffer that can be drawn upon in times of need. This reserve can help the business navigate through unexpected challenges or take advantage of unforeseen opportunities without compromising its financial stability.

Additionally, optimizing inventory management can significantly impact cash flow. Holding too much inventory ties up valuable cash, while too little can lead to stockouts and lost sales. Balancing inventory levels to meet demand without overstocking can free up cash and improve operational efficiency.

Managing Business Expenses and Controlling Costs

Cost control is a critical aspect of financial management, impacting a business’s profitability and sustainability. Managing business expenses involves not only reducing costs where possible but also ensuring that spending aligns with strategic goals and delivers value.

One approach to controlling costs is to conduct regular reviews of expenses, identifying areas where efficiencies can be achieved. This could involve negotiating better terms with suppliers, reducing energy consumption, or streamlining operations to eliminate waste.

Investing in technology can also lead to long-term cost savings. Automation of routine tasks, for example, can reduce labor costs and improve accuracy, while cloud computing can reduce IT expenses. The key is to assess the return on investment for any cost-saving initiative to ensure it aligns with the business’s financial objectives.

Moreover, adopting a culture of cost-consciousness throughout the organization can contribute significantly to managing expenses. Encouraging employees to identify cost-saving opportunities and rewarding efficiency can foster an environment where resources are used judiciously.

Tips for Managing Debt and Credit Effectively

Debt and credit are potent tools for financing business growth, but they must be managed with care. Effective debt management involves choosing the right type of financing for the business’s needs, whether that be a loan, line of credit, or other forms of credit. It also entails negotiating favorable terms and ensuring that the business can meet its repayment obligations.

One tip for managing debt effectively is to prioritize high-interest debt. Paying off loans or credit lines with the highest interest rates first can reduce the overall cost of debt and free up cash for other purposes.

Another strategy is to use debt judiciously, borrowing only when necessary and when the returns on investment justify the cost of borrowing. This requires a thorough analysis of the potential benefits and risks associated with taking on debt.

Maintaining a solid credit score is also crucial for managing debt and credit effectively. A good credit score can lead to better terms and lower interest rates, reducing the cost of borrowing. This can be achieved by making timely payments, keeping credit utilization low, and regularly monitoring credit reports for inaccuracies.

Investing in the Future: Saving and Planning for Growth

Investing in the future is an essential component of managing business finances, ensuring that the business is well-positioned for long-term success. This involves setting aside funds for investment in growth opportunities, whether that be expanding operations, entering new markets, or developing new products or services.

Saving for future investments requires discipline and foresight. It involves creating a savings plan, setting aside a portion of profits for future use, and investing those funds wisely to achieve the best return. This could involve a mix of short-term and long-term investments, depending on the business’s goals and risk tolerance.

Planning for growth also entails strategic thinking about the direction of the business and the resources needed to get there. This includes assessing market opportunities, evaluating the competitive landscape, and determining the financial implications of various growth strategies. A well-thought-out growth plan can guide investment decisions and ensure that resources are allocated effectively to achieve the desired outcomes.

Tools and Resources for Managing Small Business Finances

Several tools and resources are available to help small business owners manage their finances more effectively. Financial management software, for example, can automate many aspects of financial management, from invoicing and bill payment to budgeting and forecasting. These tools can save time, reduce errors, and provide real-time insights into the business’s financial health.

Additionally, online resources, such as financial management courses, webinars, and articles, can provide valuable information and advice on managing small business finances. These resources can help business owners stay informed about best practices, emerging trends, and regulatory changes that could impact their financial management strategies.

Professional associations and networks can also be valuable resources, offering opportunities for learning, networking, and collaboration. Connecting with other business owners and financial professionals can provide insights, support, and access to expertise that can enhance financial management efforts.

Seeking Professional Help: When to Hire a Financial Advisor or Accountant

There comes a point in managing business finances when seeking professional help becomes not just beneficial but necessary. Hiring a financial advisor or accountant can provide expertise, guidance, and support that can significantly enhance the business’s financial management.

The decision to hire a financial professional should be based on several factors, including the complexity of the business’s financial situation, the owner’s expertise and comfort level with financial management, and the cost-benefit analysis of outsourcing these functions. For many small businesses, the benefits of professional financial advice—such as improved financial performance, compliance with regulatory requirements, and strategic financial planning—far outweigh the costs.

When selecting a financial advisor or accountant, it is essential to look for someone with relevant experience, a solid track record, and a deep understanding of the challenges and opportunities facing small businesses. A good financial professional should be a trusted advisor who can provide valuable insights and support in achieving the business’s financial goals.

Case Studies: Success Stories of Businesses That Mastered Financial Management

The journey to mastering the art of managing business finances is illuminated by the success stories of businesses that have navigated this path with skill and determination. These case studies offer inspiration and practical lessons for other business owners seeking to enhance their financial management practices.

One such success story is that of a small retail business that transformed its financial performance through rigorous cash flow management and strategic debt reduction. By closely monitoring its cash flow, renegotiating terms with suppliers, and prioritizing the repayment of high-interest debt, the business was able to improve its liquidity and reduce its overall debt burden. This, in turn, enabled the company to invest in expanding its product line and entering new markets, driving significant growth.

Another example is that of a service-based business that achieved financial stability and growth through effective budgeting and forecasting. By developing a detailed budget and regularly updating its financial forecasts, the business was able to allocate resources efficiently, manage expenses, and plan for future investments. This disciplined approach to economic management supported the company’s strategic objectives and facilitated steady growth.

These case studies demonstrate that with the right strategies and discipline, businesses of all sizes and types can master the art of managing their finances, paving the way for financial success.

What software can help manage business finances more efficiently?

In today’s digital age, a plethora of software solutions can help business owners manage their finances more efficiently. These tools can automate many aspects of financial management, from accounting and payroll to budgeting and forecasting, saving time and reducing the risk of errors.

One popular accounting software is QuickBooks, which offers a range of features designed to simplify financial management for small businesses. It allows users to track expenses, manage invoices, and generate financial reports, providing a comprehensive view of the business’s economic health.

Another valuable tool is Xero, a cloud-based accounting software that offers real-time financial insights and the ability to collaborate with financial advisors and accountants. Its user-friendly interface and powerful features make it a popular choice among small business owners.

For businesses looking to improve their budgeting and forecasting, tools like PlanGuru and Float can provide sophisticated financial modeling and cash flow forecasting capabilities. These tools can help business owners plan for the future with greater accuracy and confidence.

Selecting the right software depends on the business’s specific needs and resources and the owner’s comfort level with technology. Regardless of the choice, leveraging technology can significantly enhance the efficiency and effectiveness of managing business finances.

Conclusion: The Path to Financial Success for Your Business

Mastering the art of managing business finances is a journey that requires knowledge, discipline, and strategic thinking. It is about more than just keeping track of numbers; it is about making informed decisions that drive the success and sustainability of the business.

By understanding the basics of business finance management, mastering vital financial statements, and implementing effective strategies for budgeting, cash flow management, and cost control, business owners can lay a solid foundation for economic success. Investing in the future, leveraging tools and resources, and seeking professional advice when necessary can further enhance financial management practices, supporting the business’s growth and stability.

The path to financial success is unique for every business, but the principles outlined in this guide offer a comprehensive framework for navigating this journey. With dedication and perseverance, business owners can master the art of managing their finances, turning challenges into opportunities and visions into reality.